Understanding Your Credit Score

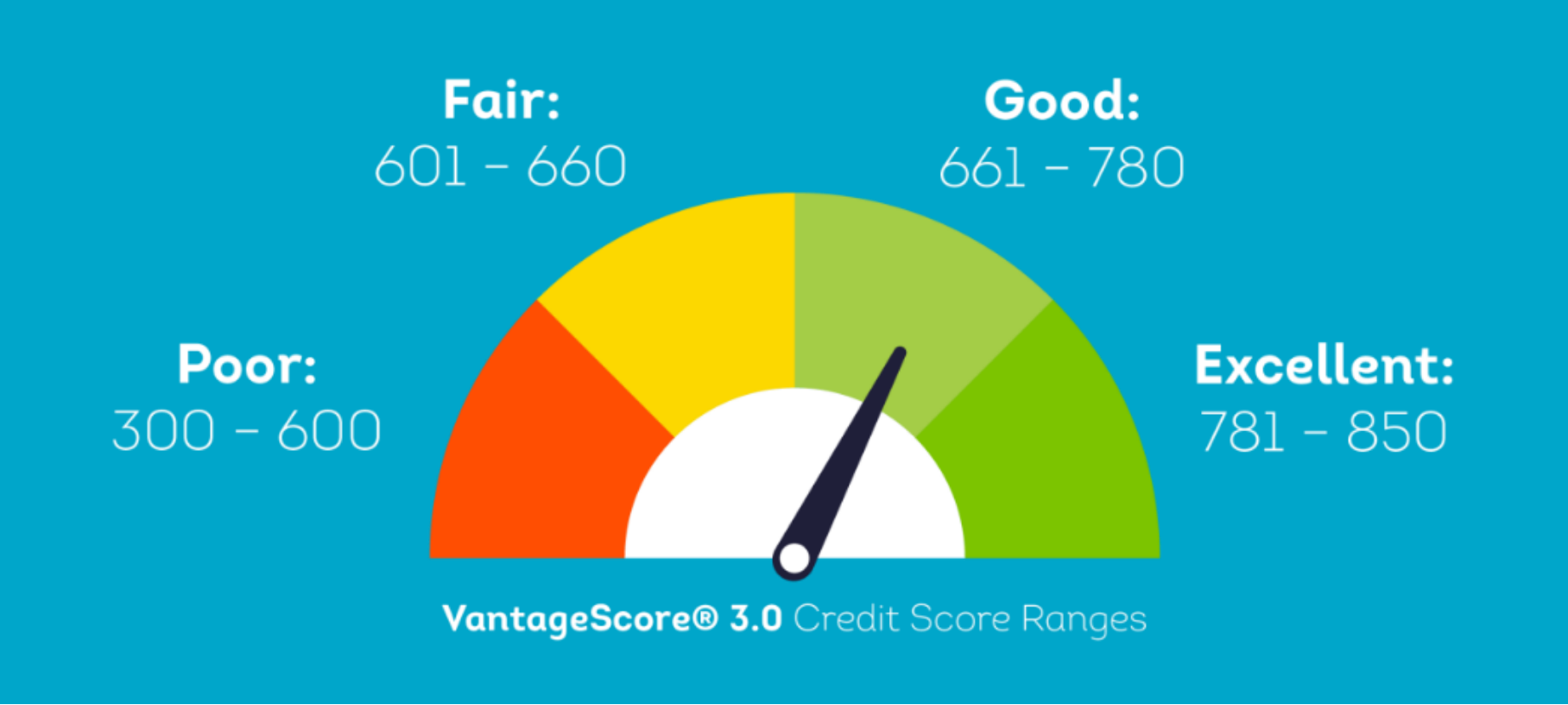

Credit scores are an important part of getting a mortgage or applying for other loans. Your score will determine the rate you qualify for, so if your score is higher than 680, you have a good chance of qualifying for the best rates.

Most companies use credit scores to determine whether you are a good credit risk or not. Equifax and Trans Union will crunch the numbers from the credit report and spit out a number somewhere between 300 and 900, or even no number or R for Reject.

A score over 680+ is considered excellent

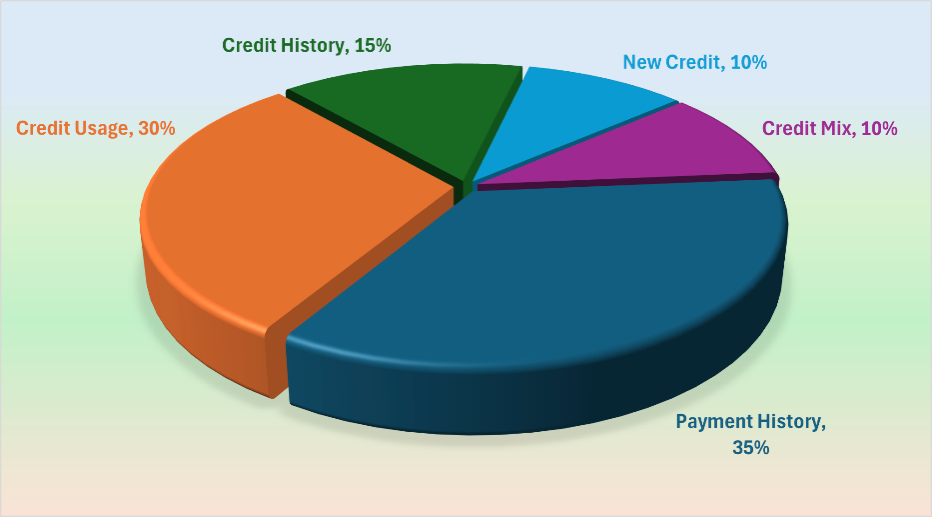

Here's how credit scores are calculated:

1. Payment history (35%): This is the most significant factor in determining your credit score. It looks at whether you have paid your bills on time, any late payments, collections, bankruptcies, or foreclosures.

2. Amounts owed (30%): This factor considers the amount of credit you are currently using compared to your total available credit, also known as the credit utilization ratio. Keeping this ratio low can positively impact your credit score.

3. Length of credit history (15%): The longer you have had credit accounts open, the better it is for your credit score. This factor looks at the age of your oldest account, the average age of all your accounts, and how long it has been since you used certain accounts.

4. New credit (10%): Opening multiple new credit accounts in a short period can be seen as risky behavior and may lower your credit score. This factor looks at the number of recently opened accounts and the number of recent credit inquiries.

5. Credit mix (10%): Lenders like to see a mix of different types of credit accounts, such as credit cards, mortgages, and installment loans. Having a diverse credit mix can have a positive impact on your credit score.

Here are some ways you can improve your credit score:

1. Pay your bills on time: Consistently making on-time payments is crucial for a good credit score. Always make at least the minimum every month. Pay off higher interest cards first with any extra payments you can make.

2. Keep your credit utilization low: Keep your credit card balances below 30% of your available credit limit. If you want to improve your score, keep it below 25% of available credit. If you have $10,000 of available credit, then your total balance owing should be less than $3,000.

3. Don't close old accounts: Keeping older accounts open can help increase the average age of your credit history.

4. Monitor your credit report regularly: Check your credit report for errors and dispute any inaccuracies that could negatively affect your score. Order a copy of your credit report annually, review it carefully and correct any significant errors:

You can also monitor your report monthly for free with other credit monitoring websites. Contact me if you would like some recommendations. Contact Me

5. Limit new credit applications: Only apply for new credit when necessary to avoid multiple hard inquiries on your credit report.

Your credit score is important and should not be neglected. If you have a low score now, we can repair it and work on ways to improve it. Reach out to me for a free consultation and a strategy session to work on improving it.

I can be reached at audie@audiewynen.com or (519) 774-0982.