13 Reasons Why You Should Use a Mortgage Professional

Before we get into why you may choose to work with a mortgage professional, let’s quickly cover what a Mortgage Professional does.

A Mortgage Professional is either a mortgage broker or a mortgage agent (who works for a broker). These licensed experts are there to guide you through the process of applying for a mortgage. It is most likely the biggest loan you will ever get, so there are a lot of things to consider, like…

- What would be the penalty if I have to break the mortgage?

- What’s better for me, fixed-rate or variable rate?

- What are my options to pay down my mortgage faster?

- How can I save $$$ in unnecessary interest?

- How can I secure the best rate?

One of the main things I like to do is educate my clients on what the ins and outs are of a mortgage. Answering these questions for you is a great start, but there is still more to think about.

Getting to know you and your goals helps me to identify how I can help you best. I ask for certain documents and ask questions to understand you, my client, better. This also helps protect both you and the industry from fraud.

As a licensed mortgage professional with the Financial Services Regulatory Authority, means that it is my duty to look out for your best interest and ensure you can afford the mortgage you are applying for. It’s also my priority to keep your information is safe and protected, and only shared with the lender(s) we choose to send it to. Each year mortgage professionals are required to go through a relicensing process to ensure we are on top of all the new compliance rules.

And here is the best part, in most cases, I do this all for FREE to you. The lenders will pay me a finder’s fee.

Now that you know what we do, here’s the list of 13 reasons why you should use a mortgage professional when you are buying your new home:

- Access to interest rates saving you thousands of $$$$. The banks don’t want you to know this! Since I send lenders millions of dollars of new business each month, they always offer us the deepest discounts which I pass on to you IMMEDIATELY – whether you are purchasing, refinancing, or renewing.

- I shop the market saving you valuable time. Calling me is like calling over 50 different lenders including Banks, Credit Unions, and Trust Companies – I have access to many of them and that will save you time.

- I don’t work for any one bank, I work for you!

- Isn’t it time the Banks compete for your mortgage business? I’ll provide you with some options so you can compare the two – what your bank is offering you and what I am able to offer you, then ultimately you decide which you feel most comfortable with. It never hurts to get a second opinion on the biggest financial obligation you will probably ever have.

- The application process is simple and quick. I’ll take some information and then send it electronically to the lenders that I feel are the best fit for your situation; 24 hr turnaround is usual! Click here for my Mortgage Application.

- Step By Step. I’ll walk you through the process of getting your mortgage, step by step. If you are a first-time homebuyer it can be an especially daunting process.

- I’m available on your terms. Days, evenings, and weekends. If you need me, I’m just a phone call or email away.

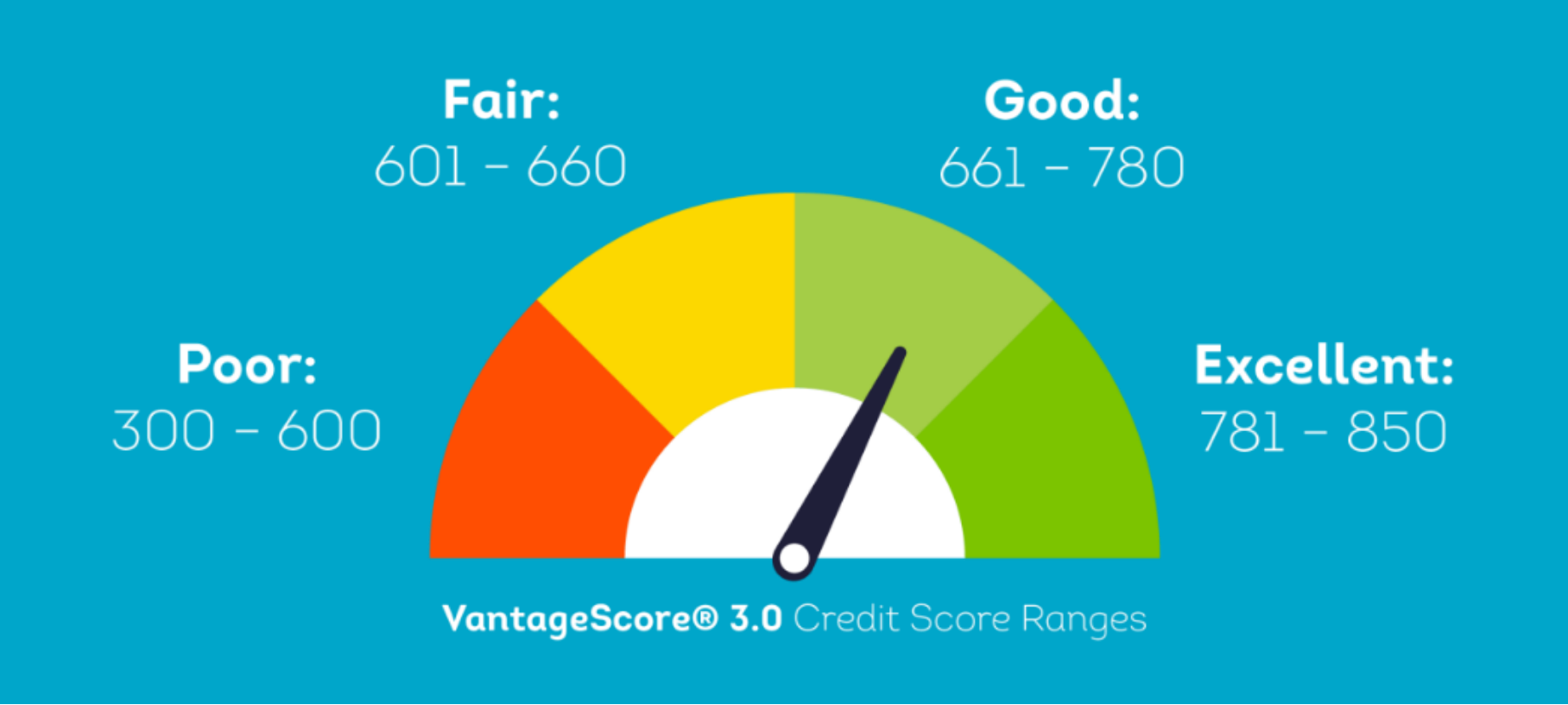

- One credit bureau, multiple lenders. Many people inadvertently disqualify themselves from getting the best rate when they are shopping for a mortgage. When multiple banks pull a credit bureau, your credit rating drops every time, sometimes eliminating the chance for the best mortgage or a mortgage at all. I take only one credit bureau but can forward your file to many lenders, increasing your chances at qualifying for a mortgage!

- Large range of products. Such as self-employed, credit challenged, no down payment, cottage properties, line of credit, 2nd mortgages, and more.

- I appreciate your business. I want to do an exceptional job for you because I want all your family and friends’ business in the future!

- Licensed Expert. Deal with a mortgage expert specializing in mortgages from all lenders, not just one.

- Rate Protection. If the rates drop before you close you automatically get the lower rate and if rates go up you have the lower rate locked in.

- Follow Up. including Annual Mortgage Check-Ups, Variable Rate Updates and the planning of your Mortgage Burning Party!

I’m sure if you’ve made it this far that you’re convinced about working with a Mortgage Professional. If you would like a free consultation, feel free to email me at audiewynen@gmail.com or call me at 519-774-0982. It would be my pleasure to work with you and get the money you need.